EV Biologics Corp, OTC PINK:YECO, today updated shareholders with further details about its NFT Warrant Dividend.

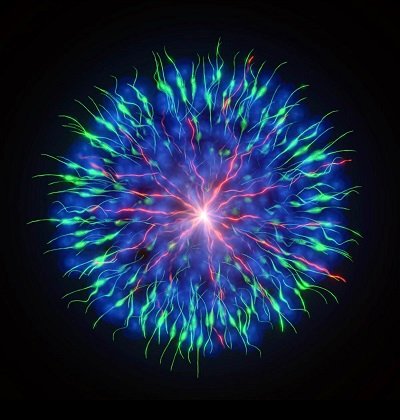

Attached is a preliminary image from the 3D animation still under development that will be issued as an NFT dividend

Daniel Mckinney CEO said: “this NFT will capture the stunning visual quality inherent in many biological systems, as in this artistic rendering of a fluorescent micrograph of a group of stem cells. The animation will elegantly illustrate a concept underlying the paracrine therapeutics that the Company is developing and commemorate a stage in our technological progress.”

Prior to the release of the final NFT, YECO’s shareholders-of-record on July 30, 2021 will receive a Warrant to exercise their right to accept ownership of the NFT. Shareholders possessing less than 100 shares will not be eligible for this special dividend.

The Company will distribute one (1) Warrant for every 100 shares of YECO common stock held. Each Warrant will be exercisable for one (1) NFT worth $300. Shareholders will have until (December 1, 2021) to exercise their Warrant(s) to receive their NFT(s).

Any shareholders-of-record on July 30, 2021, who have not received their NFT Warrant(s) before the end of August, are advised to contact their broker to claim their entitled Warrant(s). Any shareholders that have not received their expected Warrants, who believe that their shares may have been loaned for short sale without their knowledge, should contact FINRA directly (FINRA Hotline Tel 301-590-6500), as there may be uncovered short positions in the stock.

About the Company

EV Biologics (formerly Yulong Eco-Materials Limited) is a Wyoming, USA domiciled Biotechnology Company, intent on developing and enhancing the intrinsic therapeutic activity of mesenchymal stromal cell (MSC) secreted factors, as well as targeted delivery of bioactive molecules using engineered exosomes. The company is working to optimize cell lines for production of native bioactive nanoparticles and to establish an exosome engineering platform to enhance specific therapeutic activity. Initially, these novel regenerative products will be produced for preclinical research on a number of clinical indications. Using proprietary and patentable technologies, the Company is creating exclusive IP and IT inherent in these bioengineered products. Further product development will be focused on investigation of novel stem cell-derived biopharmaceuticals designed for specific clinical conditions.

Forward-Looking Statements

This news release contains forward-looking statements, particularly as related to, among other things, the business plans of the Company, statements relating to goals, plans and projections regarding the Company’s financial position and business strategy. The words or phrases ‘plans,’ ‘would be,’ ‘will allow,’ ‘intends to,’ ‘may result,’ ‘are expected to,’ ‘will continue,’ ‘anticipates,’ ‘expects,’ ‘estimate,’ ‘project,’ ‘indicate,’ ‘could,’ ‘potentially,’ ‘should,’ ‘believe,’ ‘think,’ ‘considers’ or similar expressions are intended to identify ‘forward-looking statements.’ These forward-looking statements fall within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Act of 1934 and are subject to the safe harbor created by these sections. Actual results could differ materially from those projected in the forward-looking statements as a result of a number of risks and uncertainties. Such forward-looking statements are based on current expectations, involve known and unknown risks, a reliance on third parties for information, transactions or orders that may be cancelled, and other factors that may cause our actual results, performance or achievements, or developments in our industry, to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially from anticipated results include risks and uncertainties related to the fluctuation of local, regional, and global economic conditions, the performance of management and our employees, our ability to obtain financing, competition, general economic conditions and other factors that are detailed in our periodic reports and on documents we file from time to time with the Securities and Exchange Commission. Statements made herein are as of the date of this press release and should not be relied upon as of any subsequent date, and the Company specifically disclaims any obligation, to update any forward-looking statements to reflect occurrences, developments, unanticipated events or circumstances after the date of such statement.

YECO has 7.22 million shares issued and outstanding with a float of 1,016,375 shares.